Understanding the Importance and Quality of Government Spending in India

(Source – Indian Express, Section – Explained – Page No. – 15)

|

Topic: GS3 – Indian Economy |

|

Context |

|

Analysis of the news:

Why Government Spending Matters

-

Government expenditure is fundamentally the people’s money, sourced through taxes and borrowings.

-

According to Margaret Thatcher, government spending ultimately burdens citizens, either through direct taxation or borrowing from their savings.

-

Therefore, how and where the government spends significantly impacts economic growth, social development, and the financial well-being of citizens.

-

Efficient public spending ensures optimal use of resources, leading to better infrastructure, education, healthcare, and overall economic progress.

Key Trends in India’s Public Expenditure

Over the past two decades, India’s public spending has been shaped by two major trends:

- Fiscal Discipline:

Instituted through the Fiscal Responsibility and Budget Management (FRBM) Act in 2003, fiscal discipline aims to limit government borrowing. The Act mandates that the fiscal deficit should not exceed 3% of GDP and the revenue deficit should be zero. This ensures borrowing is channeled toward capital expenditure, which enhances economic capacity rather than funding daily operational costs.

- Focus on Capital Expenditure:

Capital expenditure (Capex) is critical as it boosts the economy’s productive capacity. Investments in infrastructure like roads, railways, and ports stimulate long-term growth. In contrast, revenue expenditure, such as salaries and subsidies, offers limited long-term benefits. India’s increasing emphasis on Capex reflects a strategic shift toward sustainable economic development.

Challenges in Maintaining Spending Quality

Despite consensus on fiscal prudence and Capex emphasis, India faces challenges that affect the quality of public expenditure:

-

Crisis-Driven Spending: Events like the 2008 Global Financial Crisis and the 2020 Covid-19 pandemic forced governments to increase revenue expenditure through stimulus packages, eroding spending quality.

-

Political Populism: Policies like loan waivers and subsidies, though politically popular, divert funds from productive investments, impacting long-term growth potential.

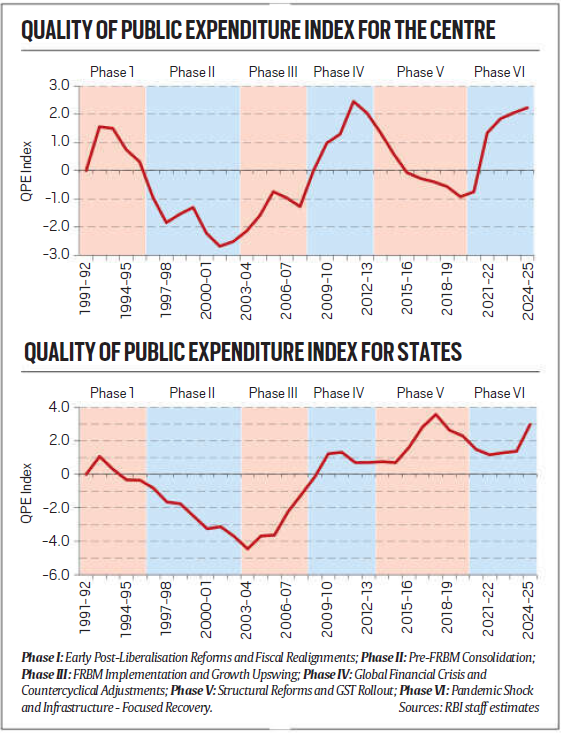

RBI’s Quality of Public Expenditure (QPE) Index

To holistically measure spending quality, the Reserve Bank of India (RBI) developed the QPE Index using five key indicators:

-

Capital Outlay to GDP Ratio: Higher ratios indicate better spending quality due to infrastructure investments.

-

Revenue Expenditure to Capital Outlay Ratio: Lower ratios suggest more productive spending.

-

Development Expenditure to GDP Ratio: Higher ratios reflect greater investments in growth-stimulating sectors like education, healthcare, and R&D.

-

Development Expenditure to Total Expenditure: A higher proportion indicates prioritization of growth-centric spending.

-

Interest Payments to Total Expenditure Ratio: Lower values indicate fiscal health, showing reduced reliance on debt.

India’s Performance Across Six Phases

The RBI’s analysis (1991-present) divides India’s spending trends into six phases:

- Phase 1 (Early Reforms):

Marginal improvements at the Centre, with states experiencing a slight decline due to fiscal pressures and reduced public investments. - Phase 2 (Pay Commission Impact):

Both Centre and states saw sharp declines in spending quality due to higher interest payments and revenue expenditures following the Fifth Pay Commission. - Phase 3 (Growth and Fiscal Discipline):

The introduction of the FRBM Act and robust economic growth improved the QPE index significantly. States also benefited from higher fiscal devolution. - Phase 4 (Global Financial Crisis):

The 2008 crisis led to increased countercyclical spending, raising deficits and slowing improvements in expenditure quality. - Phase 5 (GST and State Gains):

States improved their QPE through development-focused spending, aided by GST revenue-sharing reforms, while the Centre faced fiscal challenges. - Phase 6 (Covid Recovery and Capex Focus):

Post-Covid recovery efforts, marked by substantial capital expenditure, have pushed India’s public spending quality to near-record highs.

Conclusion

-

India’s journey toward improving public expenditure quality reflects a balance between fiscal discipline and growth-oriented investments.

-

Despite crises and political pressures, the emphasis on capital expenditure and prudent fiscal management has led to significant improvements.

-

The RBI’s QPE index now indicates that India’s public spending quality is at one of its best levels since 1991, signaling a promising trajectory for sustained economic growth.

|

Practice Question: Discuss the significance of government expenditure patterns in India with reference to the Reserve Bank of India’s Quality of Public Expenditure (QPE) index. How do fiscal discipline and capital expenditure influence economic growth and development? (150 Words /10 marks) |