World Bank Group

- Origin of World Bank

- Institutions of World Bank Group

- International Bank for Reconstruction and Development (IBRD)

- India and the World Bank

- Membership

- Organizational Structure of the World Bank

- Board of Governors

- Board of Directors

- Voting Powers

- Major Reports of World Bank

- Issues in World Bank

- Environmental Concerns

- Growth-based model unsustainable

- Way Forward

- Conclusion

- Related FAQs of World Bank Group

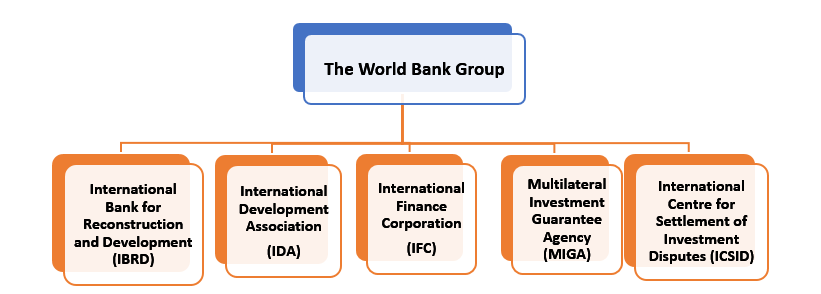

The World Bank is a group of five institutions that provide a wide range of financial products and technical assistance. These are:

- International Bank for Reconstruction and Development (IBRD)

- International Development Association (IDA), 1960

- International Finance Corporation (IFA), 1956 exclusively caters to the needs of developing countries.

- Multilateral Investment Guarantee Agency (MIGA)

- International Centre for Settlement of Investment Disputes (ICSID)

Since 1947, the World Bank has funded over 12,000 development projects, via traditional loans, interest-free credits, and grants.

Origin of World Bank

In the year 1944 (one year before World War II ended) delegates from 44 countries met at the United Nations Monetary and Financial Conference held in the Bretton Woods, New Hampshire. The objective of the conference was to establish the framework for international economic cooperation and post-war reconstruction.

The conference resulted in the formation of two international multilateral institutions, the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD, known as the World Bank). That is why they are known as the Bretton Woods Twins.

The articles of agreement of the World Bank (primarily drafted by John Maynard Keynes) included rebuilding the economies that were devastated by war and increasing the economic development of developing countries.

Institutions of World Bank Group

The World Bank Group consists of five development institutions. Two of them the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA) form the World Bank.

With the founding of the International Finance Corporation (IFC) in 1956, the institution became able to lend to private companies and financial institutions in developing countries.

The founding of the International Development Association (IDA) in 1960 put greater emphasis on the poorest countries, part of a steady shift toward the eradication of poverty becoming the Bank Group’s primary goal.

The International Centre for Settlement of Investment Disputes (ICSID) founded in 1966 settles investment disputes between investors and countries.

Multilateral Investment Guarantee Agency (MIGA) founded in 1988 insures lenders and investors against political risks such as war.

Since the mid-2000s the World Bank is now seen as a knowledge institution and not only an institution that provides financing. In collaboration with the United Nations’ Sustainable Development Goals in 2015, the World Bank now emphasizes community-driven development, working to safeguard vulnerable populations, and mitigating the impact of climate change.

International Bank for Reconstruction and Development (IBRD)

The IBRD was founded in 1944. It has a membership of more than 180 countries. The world’s largest development bank, it provides loans, guarantees, advisory services, and risk management products to middle-income and creditworthy low-income countries.

- IBRD provides services to only sovereign governments and not private players.

- Middle-income countries represent more than 60% of the IBRD’s portfolio.

- IBRD extends loans to member countries for a range of development projects, including infrastructure development, achievement of Sustainable Development Goals, education, healthcare, and environmental sustainability. These loans come with favourable terms, including extended repayment periods and low interest rates.

- IBRD finances investments across all sectors and offers technical support and expertise at every stage of a project.

- It also assists governments in augmenting the investment climate of countries, removing service delivery bottlenecks, and strengthening institutions and policies.

- IBRD sources most of its funds from the world’s financial markets.

India and the World Bank

India is a founding member of IBRD. The cooperation between the World Bank and India goes back to the foundation of the International Bank of Reconstruction and Development in 1944:

- India received its first bank loan of US$ 34 million from the International Bank of Reconstruction and Development in November 1948 for railway rehabilitation.

- During the 1950s, the IBRD was India’s sole source of World Bank borrowings.

- Since the 1960s, the IBRD has been an important source of long-term funding for India.

- During the 1960s and 1970s, the IDA accounted for nearly three-fourths of all WB lending to India and, in turn, India was by far the largest recipient of IDA funds, accounting for more than two-fifths of all its lending.

- India is the largest IBRD client of the World Bank.

- The lending portfolio changed sharply after the 1991 macroeconomic crisis. India became one of the last important borrowers in order to undertake structural adjustment lending.

India is a blended country, which means it is transitioning from a lower-middle-income to a middle-income country. India is eligible for loans from both the IBRD and the IDA.

Currently, the World Bank Group (WBG) has approved a $25-30 billion commitment plan for India for the period 2019-22.

Membership

A country must first become a member of the IMF then only it can become a member of the World Bank Group. Further, to become members of the IDA, IFC, and MIGA, the countries must first become members of IBRD.

Membership of the ICSID is subject to the following requirements:

- Membership of IBRD

- Must be a Party to the Statute of the International Court of Justice

- Invitation of the Administrative Council of ICSID with two-thirds of its members voting in favour.

Organizational Structure of the World Bank

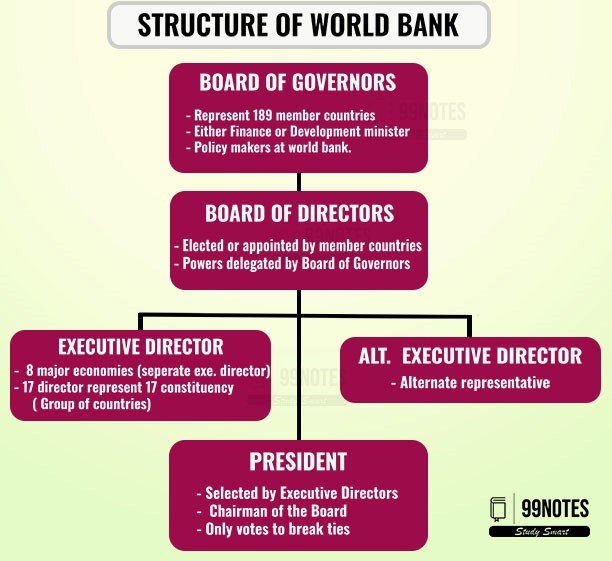

The World Bank is like a cooperative organization where members are countries. At present, it has 189 member countries. These member countries are shareholders of the World Bank.

The World Bank is like a cooperative organization where members are countries. At present, it has 189 member countries. These member countries are shareholders of the World Bank.

Board of Governors

The Members are represented by a Board of Governors, who functions as the ultimate policymakers of the World Bank. The Boards of Governors consist of one Governor and one Alternate Governor appointed by each member nation. They are usually the country’s finance minister, governor of its central bank, or a senior official.

The Governors and Alternate Governors serve for terms of five years and can be reappointed. The Board meets once a year at the Annual Meeting of the Boards of Governors of the World Bank Group and the IMF.

Role of the Boards of Governors

The Board of Governors is the World Bank’s senior decision-making body. The Boards of Governors has delegated all powers to the Executive Directors except those mentioned in the Articles of Agreement. These powers are as follows:

- Admit or suspend members.

- Increase/decrease the authorized capital stock.

- Determine the distribution of net income of the Bank.

- Decide appeals arising from interpretations of the Articles of Agreement by Executive Directors.

- Make arrangements to coordinate and cooperate with other international organizations.

- Raise the number of elected Executive Directors; and

- Approve amendments to Articles of Agreement.

Board of Directors

The Boards of Directors exercise powers that are delegated to them by the Boards of Governors, making it the most important body in the World Bank Group.

Appointment of Executive Directors

It consists of the World Bank Group President and 25 Executive Directors. The executive directors represent all 189 member countries. Executive Directors are elected every two years at the time of the Annual Meetings.

- Eight countries (the US, Japan, China, Germany, France, the UK, Russia, and Saudi Arabia) with large economies have their own executive directors.

- The rest of all countries are grouped in 17 constituencies with each director representing 4 or more countries.

- India is grouped together with Bangladesh, Sri Lanka, and Bhutan who together elect a director.

The Board of Directors of the World Bank Group consists of four separate Boards, namely the Board of IBRD, the IDA, the IFC, and the MIGA. Each Board is responsible for the operations of their respective organization.

While there are four Boards of the World Bank Group, Executive Directors on these Boards are generally the same.

Role of Executive Directors

Executive Directors have a dual function:

- Firstly, as officials of the Bank and

- Secondly as representatives of the member country/countries that have appointed/elected them.

The Executive Directors are responsible for conducting the day-to-day business of the World Bank, such as:

- Deciding on loan/credit proposals made by the President.

- Deciding policy issues that guide the general operations of the Bank.

It has been a convention that the World Bank’s president is an American citizen. The President also serves as Chairman of the Board of Directors and is selected by the Executive Directors. The President acts as presiding officer and has no vote except a deciding vote in case of an equally divided Board.

The World Bank operates daily under the direction of the president, management, and senior staff, and the vice presidents in charge of Global Practices assisted by other supportive staff.

Voting Powers

The voting power of each Member country is based on its shareholding. There are different voting powers in each organization as shares are allocated differently in each of the organizations.

Major Reports of World Bank

- Ease of Doing Business (Stopped publishing): In the EODB index, ‘higher rankings’ (a lower numerical value) indicate better, usually simpler, regulations for businesses and stronger protections of property rights.

- Human Capital Index: This index measures the amount of human capital that a child born today can expect to attain by age 18, given the risks of poor health and poor education that prevail in the country where she lives.

- World Development Report: The World Development Report (WDR) is an annual report published since 1978 by the World Bank. Each WDR provides an in-depth analysis of a specific aspect of economic development.

Issues in World Bank

World Bank faces criticism, and rightfully so, over four key issues:

- Structural under-representation of the Global South: The political power imbalances in their governance structures where, as a result of voting shares based principally on the size and ‘openness’ of countries’ economies, poorer countries – often those receiving loans from the World Bank – are structurally under-represented in decision-making processes

- Undermining democratic ownership: The issue of political power imbalances is exacerbated by another long-standing critique of the Bank: that the economic policy conditions they promote – often attached or ‘recommended’ as part of loans, projects, technical assistance, or financial surveillance – undermine the sovereignty of borrower nations, limiting their ability to make policy decisions and eroding their ownership of national development strategies.

- Weak ability to learn from past mistakes: The World Bank created the Independent Evaluation Group (IEG) in 2006, integrating several individual accountability mechanisms, and was charged with evaluating the activities of the entire World Bank Group and determining what works, what doesn’t, and why. However, the Bank has been criticized for failing to implement the recommendations.

Environmental Concerns

The approach to development, economic policy, as well as the financing decisions of the World Bank have generated long-standing and ever-more pressing criticisms related to the protection of the environment and staving off climate change.

- The growth-based approach to poverty reduction that the World Bank promotes has immense environmental consequences, as is evidenced by the deepening climate crisis.

- Further another major concern is the planned mega corridors in developing regions are predicated on building a new generation of carbon-intensive infrastructure.

Focus on mega-projects

- Since 2015, there has been a particular emphasis on promoting ‘infrastructure as an asset class’, in order to crowd in institutional investors.

- This policy initiative is highly dependent on mega-infrastructure projects and currently lacks a framework for aligning such mega-projects with the Paris Climate Agreement or the Sustainable Development Goals (SDGs).

Growth-based model unsustainable

- The growth-based approach to poverty reduction that the World Bank promotes has immense environmental consequences, as is evidenced by the deepening climate crisis.

- While the Bank has increasingly tried to account for environmental and climate factors in their work over recent decades, these efforts have largely been limited to attempting to integrate these concerns into a growth-based development model.

Way Forward

- Deep reforms of the World Bank are necessary as part of rethinking the current world order, and giving rising powers and developing countries a meaningful voice in this institution.

- The Bank needs to create space for reflection on the purpose of the multilateral body, the substantive role it should play in the future, the need to strengthen inclusive multilateralism, and the actions needed to bolster the position of emerging economies and developing countries.

- The head of the body should be selected on merit. That would signal an important departure from the past.

- There is a desperate need for these institutions to be more transparent, represent, and speak for countries that don’t get adequate representation. This would ensure an equitable distribution of resources and more concern for equitable development for growth.

Conclusion

The World Bank is critical to the development of impoverished and emerging countries. It encourages investments in nations that support long-term prosperity and helps residents satisfy their needs. It collaborates with policymakers to create stable, egalitarian, and efficient markets, institutions, and economies. It assists countries in sustainably meeting their critical infrastructure demands. It provides customers with the means to make educated development decisions for long-term impact through analysis, guidance, financial instruments, conveying capacity, and, most importantly, a solid evidence base.

Related FAQs of World Bank Group

The World Bank is a global development institution that provides loans, grants, and technical support to developing countries to reduce poverty and support development. Unlike the IMF, which deals with monetary cooperation and short-term financial stability, the World Bank focuses on long-term economic development and poverty reduction.

The World Bank Group includes: 1) IBRD (International Bank for Reconstruction and Development), 2) IDA (International Development Association), 3) IFC (International Finance Corporation), 4) MIGA (Multilateral Investment Guarantee Agency), and 5) ICSID (International Centre for Settlement of Investment Disputes).

India is a founding member of the World Bank and its largest IBRD client. It has received financial assistance for key development projects since 1948 and continues to access funds from both IBRD and IDA as a transitioning economy. India plays a key role in shaping global development dialogue.

Critics argue that the World Bank underrepresents developing nations, undermines national sovereignty through conditional lending, promotes environmentally harmful mega-projects, and focuses on a growth-based model that may not be sustainable in the long run.

The World Bank needs deep reforms to become more inclusive, transparent, and sustainable. There’s a call for greater representation of the Global South, merit-based leadership selection, stronger alignment with climate goals, and policies that prioritize equity over pure economic growth.