Corporate governance

Corporate governance is the system of rules, practices and processes by which a firm is directed and controlled.

- It essentially involves balancing the interests of a company’s many stakeholders, such as shareholders, management, customers, suppliers, financiers, government and the community.

- Since corporate governance also provides the framework for attaining a company’s objectives, it encompasses practically every sphere of management, from action plans and internal controls to performance measurement and corporate disclosure.

Good v/s Bad Corporate Governance

- Good v/s Bad Corporate Governance

- Fundamental Objectives of Corporate Governance

- Issues in corporate governance in India:

- Insider Trading:

- Noncompliance with disclosure norms:

- Principles of Corporate Governance

- Social Responsibility

- Four Ps of Corporate Governance:

- Regulatory Framework for Corporate Governance in India

- What is a Non-executive director?

- Reforms Required in India’s Corporate Governance

- SEBI reforms related to Independent Directors

- FAQs related to Corporate governance

A well-defined and enforced organization that works for the advantage of everyone involved by ensuring that the firm complies with acknowledged ethical standards, best practices, and formal regulations is an example of good corporate governance. On the other hand, bad corporate governance is characterized by a lack of structure, ambiguity, and compliance, all of which can harm a company’s reputation and financial health.

Corporate governance practices, even in the most reputed listed Indian companies, have been questionable on a number of dimensions and occasions, which steers the demand for a higher quality/level of corporate governance.

For example, Removal of Cyrus mistry.

Fundamental Objectives of Corporate Governance

Corporate governance is a method of structuring, operating, and controlling a business with the following specific goals:

Building Trust:

- To create positive sentiment in the minds of investors and the public at large. An ethically-based corporate governance leads to more trust in the organisation and its work culture leading to more investors’ interest.

- Aligning the aims of the corporation with the stakeholders (society, shareholders, etc.)

- It aims to define the Board of Directors’ and managers’ responsibilities to achieve good corporate performance.

- It minimises Environmental and community concerns.

Profits:

Ethical Corporate Governance helps in growing the reputation of a company and thus, increases profits.

- It leads to better relationships among stakeholders that enhance the performance of organizations.

- Maximises long-term shareholder value.

- Achieving the owners’ long-term strategic goals.

Business performance:

Good corporate ethics also enhances overall business performance, particularly leading to improved competitive advantage through good governance, higher financial returns, and better reputation.

- It boosts the corporate functioning and discourages mismanagement by investing in profitable investment outlets.

Employees’ motivation:

Good corporate ethics improves the situations of the employees and Safeguarding the interests of employees.

- It leads to higher retention and better morale.

- It also leads to a more effective recruitment process, loyalty, motivation, and productivity in the company.

Customer relationships:

With ethical governance, Customer relationships are also improved.

- This increases customer loyalty, enhances brand image, and caters to customer service and satisfaction.

- With ethical business practices, complaints and issues of customers are solved transparently leading to trust in the corporation.

Issues in corporate governance in India:

Concentration of powers:

- Ownership of corporations in India, is still held in a few hands. This leads to several governance-related challenges and has often led to poor decision-making that harms the company’s profits.

For example, the Satyam Computer Services scandal in 2009, where the company’s chairman admitted to manipulating the company’s accounts, highlighted the risks of concentrated ownership and lack of effective checks and balances.

- Family Led Businesses: Many Indian businesses are old family establishments. With the growth of the family and its business, there is an increase in inefficiencies and internal conflicts that threaten the continuity of the business. Family control also brings governance problems like a lack of checks and balances over executive decision-making and a lack of transparent reporting.

For example the case of Fortis Healthcare, where the founders were accused of siphoning funds through RPTs(Related Party Transactions).

Dysfunctional or ineffective boards:

In leading companies and institutions, board memberships are lucrative, and prestigious and carry attractive perks. Board members have every incentive to nod their heads to whatever the management wants done.

- The problem of credentials of board members or their domain expertise. Often family members of the executives become board members.

- Independent directors have hardly been able to make the desired impact due to the passive role played by them on board. For example, IL&FS (Infrastructure Leasing & Financial Services) crisis in 2018 shed light on the failure of the board to manage risks and maintain financial stability.

- The frequent removal of directors: This issue has not been addressed effectively yet, despite the strengthening of the regulations regarding independent directors.

- Absence of penalties where directors do not live up to their mandate.

- Problematic Selection process of Board members: they are selected by top management (or, in India, by the promoter who is also top management). As long as the top management selects all board members or can influence their selection, there is little hope of any active challenge to management. If we are to bring about meaningful change, we need to bring diversity in the selection of board members.

For example, Chitra Ramanathan Case: At the NSE, there were five PIDs who were required to keep SEBI informed about any untoward happenings. They failed to do so. All we can say is that where independent directors are chosen by diverse stakeholders, there is at least the theoretical possibility of directors challenging the top management.

- The dissenting board member becomes an outcast on the board — they will find it difficult to make conversation over lunch. In the closed club from which board members are drawn, word spreads that the dissenter is a ‘troublemaker’. Other boards will be reluctant to touch him.

Corporate Ethics and Fraud:

Instances of fraud, unethical practices, and lack of accountability have been significant issues in Indian corporate governance.

For Example– The Satyam scandal is the more recent allegations of fraud and financial irregularities in companies like Punjab National Bank (PNB) and Yes Bank, which have highlighted the need for stronger ethical standards and more robust internal controls.

Insider Trading:

Corporate insiders like officers, directors, and employees by virtue of their position have access to confidential information. Many misappropriate that information to reap profits.

SEBI lacks a thorough investigative mechanism and a vigilant approach due to which the culprits are able to escape. In most of the cases, SEBI failed to produce evidence and corroborate its stance before the court.

For Example, Infosys was found in violation of SEBI insider trading regulations when it failed to make public an allegation of a company insider regarding illegal trading. While the original complaint was filed on September 20, 2019, the matter came to light when the whistleblower mailed a copy of the same to the media a month later. Eventually, the independent director of Infosys, Kiran Mazumdar Shaw, settled the charges by paying a fine of only Rs. 3 Lakh to SEBI.

Noncompliance with disclosure norms:

Noncompliance with disclosure norms is common in Indian businesses with hardly any punitive action. While the Companies Act provides clear instructions for maintaining and updating registers, in reality, minority shareholders have often suffered from irregularities in share transfers.

For Example, RBI imposed a fine of ₹32.30 on Canara Bank for non-compliance with certain directions on ‘Data Format for Furnishing of Credit Information to Credit Information Companies and other Regulatory Measures’, ‘Resolution Framework 2.0 – Resolution of Covid-19 related stress of Micro, Small and Medium Enterprises (MSMEs)’ and ‘Resolution Framework – 2.0: Resolution of Covid-19 Related Stress of Individuals and Small Businesses’.

Principles of Corporate Governance

The principles of Corporate Governance are as follows:

Accountability

Accountability means to be answerable and be obligated to take responsibility for one’s actions. By doing so, two things can be ensured-

- That the management is accountable to the Board of Directors.

- That the Board of Directors is accountable to the shareholders of the company.

This principle gives confidence to shareholders in the business of the company that in case of any unfavourable situation, the persons responsible will be held in charge.

For example, Each publicly traded corporation must file an annual report containing audited financials.

Transparency

Providing clear information about a company’s policies and practices and the decisions that affect the rights of the shareholders represents transparency. This helps to build trust and a sense of togetherness between the top management and the stakeholders. It ensures accurate and full disclosure on material matters like financial condition, performance, and ownership.

For example, disclosure of all conflicts of interest by the directors, the percentage of shareholding of the directors, list of political donations made by the company etc.

Independence

Independence means the ability to make decisions freely without being unduly influenced. Decisions should be made freely without having any personal interest in the company. It ensures the reduction in conflict of interest. Corporate governance suggests the appointment of independent directors and advisors so that decisions are taken responsibly without influence.

For example, If an auditor is a longstanding friend of a client, the auditor may not be sufficiently independent of the client.

Fairness

Fairness allows shareholders to voice their grievances and address any issues relating to the violation of shareholder’s rights. This principle deals with the protection of shareholders’ rights, treating all shareholders equally without any personal favouritism, and granting redressal for any violations of rights.

For example, All shareholders should receive equal consideration for whatever shareholdings they hold.

Social Responsibility

Apart from the 4 main principles, there is an additional principle of corporate governance. Company social responsibility obligates the company to be aware of social issues and take action to address them. In this way, the company creates a positive image in the industry. The first step towards Corporate Social Responsibility is to practice good Corporate Governance.

For example, Companies engaging in environmental preservation efforts, ethical labour practices, philanthropy, and promoting volunteering.

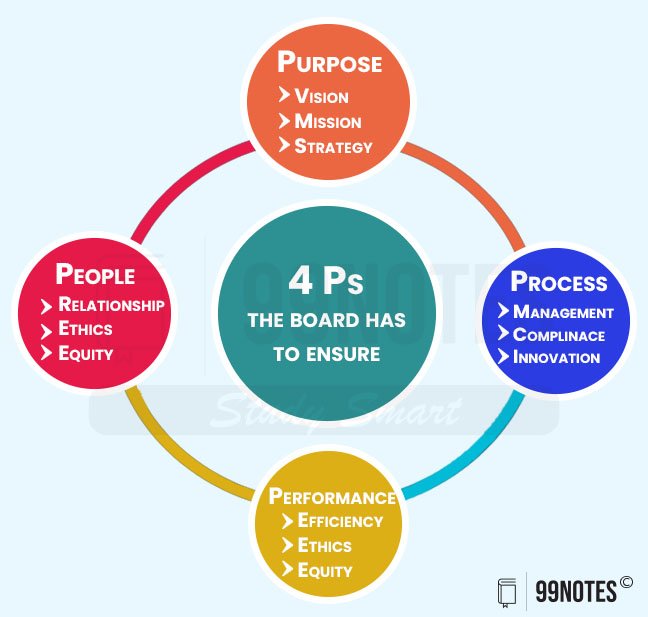

Four Ps of Corporate Governance:

Corporate Governance is built on four pillars that we like to call the 4 P’s, as we discussed below:

- People: This ‘P’ emphasizes the importance of the individuals involved in corporate governance, including the board of directors, executives, and employees. The composition of the board, their skills, independence, and diversity are crucial factors.

- Purpose: Purpose refers to the overarching mission and goals of the company. Corporate governance ensures that the company’s purpose aligns with ethical standards and is focused on creating long-term value for shareholders and stakeholders.

- Processes: This ‘P’ involves the systems and procedures established to oversee and manage the company. Governance processes include how decisions are made, how risk is assessed and managed, and how accountability is maintained.

- Practices: Performance in corporate governance relates to the company’s overall success in achieving its goals while adhering to ethical standards. The governance framework monitors and evaluates the performance of the company against established benchmarks.

Regulatory Framework for Corporate Governance in India

The Ministry of Corporate Affairs (MCA) and the Securities and Exchange Board of India (SEBI) play pivotal roles in overseeing corporate governance initiatives in India.

Their responsibilities encompass establishing and enforcing regulations to ensure ethical business practices and safeguard the interests of stakeholders.

Corporate Governance Regulation:

- In the 1990s, SEBI took charge of regulating corporate governance through key laws such as the Security Contracts (Regulation) Act, 1956; Securities and Exchange Board of India Act, 1992; and the Depositories Act of 1996, marking a crucial period of regulatory development.

- Introduction of Formal Regulatory Framework: In a landmark move in 2000, SEBI instituted the first formal regulatory framework for corporate governance in response to recommendations from the Kumar Mangalam Birla Committee, in 1999.

- This initiative aimed to enhance corporate governance standards in India and laid down guidelines for transparent and accountable business practices.

Subsequent Governance Initiatives:

- Building on these developments, a significant corporate governance initiative unfolded in 2002 when the Naresh Chandra Committee on Corporate Audit and Governance extended its recommendations to address various governance issues.

- Notable examples include setting up the Confederation of Indian Industry (CII), the National Foundation for Corporate Governance (NFCG), and the Institute of Chartered Accountants of India (ICAI), all working collectively to foster responsible and transparent corporate practices in the country.

Companies Act, 2013:

The Companies Act, 2013 is a comprehensive legislation enacted by the Indian Parliament to regulate the incorporation, functioning, and governance of companies in India. It replaced the Companies Act, 1956, aiming to enhance corporate transparency, accountability, investor protection, and ease of doing business, aligning Indian practices with global standards.

Provisions Related to Corporate Governance:

- These provisions include greater accountability on companies through the appointment of Key Managerial Personnel (KMPs), the role of audit committees, independent audits, stricter regulation of related party transactions, and restrictions on layers of companies.

- Enhanced disclosures are mandated, including through the board’s report, financial statements, and filings with the Registrar of Companies, to ensure that all relevant information is available to investors and regulatory agencies.

Amendments and Updates:

- Some of the key amendments include the introduction of the National Company Law Tribunal (NCLT) and the National Company Law Appellate Tribunal (NCLAT) to replace the Company Law Board, and the introduction of the Insolvency and Bankruptcy Code, 2016.

- The amendment of the definition of “related party” to include entities holding equity shares of 10% or more in the listed entity either directly or on a beneficial interest basis.

- The Act has also been amended to provide for the appointment of an independent director in case of a company with a paid-up share capital of ten crore rupees or more, and the requirement of a special resolution for the appointment of an auditor.

National Financial Reporting Authority (NFRA):

NFRA is an Indian regulatory body that was established in 2018, under section 132 of the Companies Act, 2013. The duties of the NFRA include recommending accounting and auditing policies and standards to be adopted by companies for approval by the Central Government etc.

What is a Non-executive director? |

He is a director in a company who does not have a fiduciary relationship with the company, and/or has not been an executive with the company in the three preceding financial years.

|

Reforms Required in India’s Corporate Governance

Despite several reforms to strengthen the structure of corporate governance in India, several key issues remain, as discussed in the previous chapters.

A few reforms have been long overdue according to various experts in the field.

Increasing the number of independent directors:

The top management must be allowed to choose not more than 50% of the independent directors. The rest must be chosen by various other stakeholders — financial institutions, banks, small shareholders, employees, etc.

- Since society has a large stake in any corporation (due to environmental, societal and other concerns), the government should have the freedom to make such appointments on behalf of the society.

- Then, we will have independent directors who are not beholden to the top management for their jobs. They will be accountable, not to the top management, but to the stakeholders who have appointed them.

Improving regulatory structure:

Regulators act against directors where there is financial malfeasance. They seldom act where there are breaches of regulation as in the present instance. This must change.

- Regulators must penalise errant directors through a whole range of instruments — strictures, financial penalties, removal from boards and a permanent ban from board membership.

- We need periodic independent audits of all regulators by a panel of eminent persons. The audits must evaluate the regulators’ performance in relation to their objectives.

- The internal processes and governance mechanisms of regulators must be subjected to the glare of public scrutiny. It is vital to guard the guardians.

SEBI reforms related to Independent Directors

In March 2018, the SEBI made important decisions based on the recommendations of the Kotak committee on corporate governance, including the following:

- Reduction in the maximum number of listed entity directorships from:

- 10 to 8 by April 01, 2019, and

- to 7 by April 1, 2020

- Expanding the Eligibility Criteria for Independent Directors

- Disclosure of expertise/skills of directors

- Enhanced role of the Audit Committee, Nomination and Remuneration Committee and Risk Management Committee.

- Disclosure of utilization of funds from QIP/preferential issue.

- Disclosures of auditor credentials, audit fees, reasons for resignation of auditors, etc.

- Enhanced disclosure of related party transactions (RPTs) and related parties to be permitted to vote against RPTs

- Mandatory disclosure of consolidated quarterly results with effect from FY 2019-20

- Enhanced obligations on the listed entities with respect to subsidiaries

- Secretarial Audit to be mandatory for listed entities and their material unlisted subsidiaries under SEBI Listing Obligations and Disclosure Requirements (LODR) Regulations.

Further, several recommendations were accepted with modifications:

- Minimum 6 directors in the:

- top 1000 listed entities by market capitalization by April 1, 2019, and

- in the top 2000 listed entities by April 1, 2020

- At least one woman independent director in the top 500 listed entities by market capitalization by April 1, 2019, and in the top 1000 listed entities by April 1, 2020

- Separation of CEO/MD and Chairperson (to be initially made applicable to the top 500 listed entities by market capitalization w.e.f. April 1, 2020)

- The quorum for Board meetings: (1/3rd of the size of the Board or 3 members, whichever is higher) in the top 1000 listed entities by market capitalization by April 1, 2019, and in the top 2000 listed entities by April 1, 2020

- Top 100 entities to hold AGMs within 5 months after the end of FY i.e. by August 31, 2019.

- Webcast of AGMs will be compulsory for the top 100 entities by market capitalization w.e.f. FY 2018-19.

- Shareholder approval (majority of minority) for royalty/brand payments to related parties exceeding 2% of consolidated turnover (instead of the proposed 5%).

- The board decided to refer certain recommendations to various agencies (i.e. government, other regulators, professional bodies, etc.), considering that the matters involved relate to them. Such recommendations, inter-alia, include strengthening the role of ICAI, internal financial controls, adoption of Ind–AS, and treasury stock, among others.

In light of the recent and alarming corporate frauds and banking scams, SEBI’s sanction of the Committee’s recommendations would in all likelihood make the contemporary corporate scenario more transparent, accountable and sustainable.

| Kotak Committee on Corporate Governance |

| This committee was formed in 2017 under the chairmanship of Uday Kotak. The Committee was represented by different stakeholders, including the government, the industry, stock exchanges, academicians, proxy advisors, professional bodies, lawyers, etc.

Objective: improving standards concerning corporate governance of listed companies in India. It was requested to provide recommendations on diverse issues such as:

The Committee submitted its report detailing several recommendations in October 2017. |