Will Trump’s tariffs bring in a recession?

(Source – The Hindu, International Edition – Page No. – 10)

|

Topic: GS2 – International Relations, GS3 – Economy |

|

Context |

|

Reversal of U.S. Free Trade Policy

-

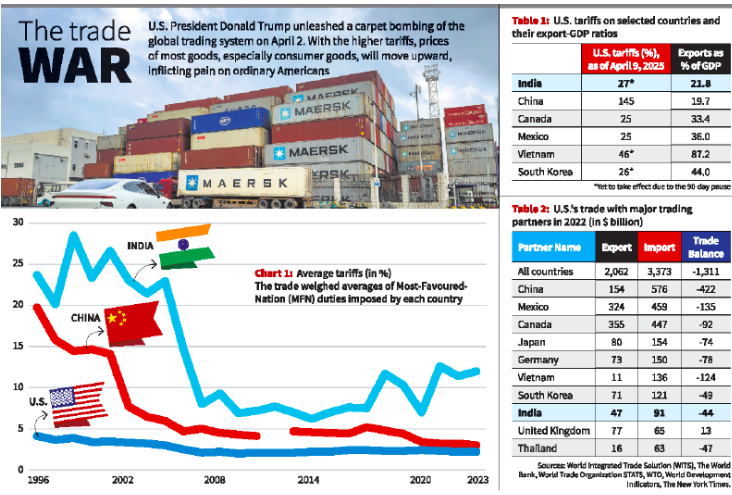

Tariffs on imports from 60 countries have been increased even more, including 20% on the European Union, 27% on India, and 46% on Vietnam.

-

Earlier, U.S. tariffs were around 2–3% for two decades, but now these are sharply raised.

Tariffs on Key Trading Partners

-

In February, 25% tariffs were already placed on goods from Mexico and Canada, two of the U.S.’s biggest trade partners.

-

The most severe impact is on imports from China, which now face 145% tariffs starting April 11.

-

China supplies about one-sixth of all goods imported into the U.S.

Market and Global Reaction

-

The sudden and steep tariff hike shocked global markets.

-

Stock markets dropped sharply due to the uncertainty.

-

China responded with 125% tariffs on U.S. goods, leading to fears of a global recession.

-

On April 9, the U.S. paused the new tariffs for most countries for 90 days, except for China.

Trade Deficit and Globalisation

-

The U.S. imports more than it exports, creating a trade deficit of $1,311 billion or 5% of its GDP in 2022.

-

Despite this, it has continued global purchases due to the dominance of the U.S. dollar.

-

China supports the dollar by buying U.S. treasury bonds, making both economies strongly linked.

-

Globalisation has helped developing countries but also caused job losses in sectors like steel and automobiles in the U.S.

China’s Response Strategy

-

China has reduced its reliance on exports and the U.S. economy.

-

Its exports-to-GDP ratio dropped from 35% in 2012 to 19.7% in 2023.

-

China has focused on technology, innovation, electric vehicles, and AI, and shifted production to other Asian countries to avoid tariffs.

Impact on India

-

India exported goods worth $91 billion to the U.S. in 2022.

-

The new U.S. tariffs could hurt India’s export income, though pharmaceuticals and services remain unaffected.

-

With exports forming only 21.8% of India’s GDP, the damage may be limited.

-

However, weak manufacturing capacity and limited impact of schemes like PLI remain challenges.

-

India needs a strong industrial policy and more investment to face global trade shifts effectively.

|

Practice Question: The recent shift in the United States’ trade policy from liberalisation to protectionism marks a turning point in global trade dynamics.” Discuss its implications for India’s economy and suggest suitable policy responses. (250 Words /15 marks) |